If you are new to cryptocurrency trading, you can start by reading up on the market and taking some courses. Online courses, tutorials, and books are an excellent way to learn more about this exciting market. Even a little training will help you make smarter trading decisions. You can brush up on futures fundamentals, learn about basic technical analysis tools, and set stop-loss orders. It is also important to set a sensible money-management system. One of the best approaches is to invest a certain percentage of your funds on every trade.

Leverage

Leverage in crypto trading is a way to increase the potential gain on a futures bet. It works by allowing you to borrow money from an exchange. Leverage rates vary from platform to platform. Some exchanges allow up to 50x leverage, while others restrict it to only 20x.

One of the most popular margin trading sites is Bitwells. Its advanced platform allows you to buy and sell contracts for cryptocurrencies. With up to 100x leverage, it allows you to buy up or sell down the market, and take profits either way. Bitwells offers a free demo account, zero KYC, and mobile apps. This trading platform has earned the trust of more than 200k traders worldwide.

Leverage is a powerful tool, but it must be used cautiously. As with any trading, it carries high risk. If you make a mistake, you could lose all of your investment. It is also important to use risk management techniques such as stop-loss, which will automatically close your position at a certain amount if the market moves against you. Also, trading with smaller amounts will minimize risk and enable you to retain more funds.

Liquidity

Liquidity is one of the most important features of a trading exchange. Without it, an exchange would not be able to run smoothly. This is especially true with cryptocurrency exchanges, where the market can be extremely volatile. Traders are often looking for the fastest way to cash out their investments, so they want the best liquidity possible. However, this can lead to some problems. For instance, new tokens on crypto exchanges are often thinly traded, causing supply and demand issues and reducing liquidity.

Liquidity in cryptocurrency futures trading can be improved by leveraging new tools. One of the best ways to achieve this is through spread trading. Spread trading involves buying one security and selling another in the same security. The overall net trade will have a positive value. Another way to increase liquidity is through cash and carry trading. In this technique, traders buy an asset and sell the derivative associated with it.

Liquidity in crypto futures trading depends on the number of trading participants. A good liquidity provider should be able to execute trades with minimal slippage and offer competitive spreads, commissions, and swaps. In addition, it should offer reliable price feeds. These price feeds should include prices from all relevant exchanges and the Forex market. Otherwise, there might be unacceptable price gaps. An advanced liquidity provider should also offer FIX protocol connections and MT4 integration. You must join forex training course in order to become the ins and outs of forex and crypto trading.

Taxes

When you trade cryptocurrency, you must pay attention to taxes, particularly if you are involved in margin trading. In most countries, profits earned through margin trading are taxed as capital gains. In most cases, you must pay taxes on the difference between the price you pay and the price you receive.

However, Here https://www.btcc.com/ are some special rules for certain types of crypto trading. For example, if you sell a portion of a Bitcoin future or option, you must pay tax on the closing price of the transaction. You must also be aware of the rules that apply to section 1256 contracts.

In addition to this, you should also know that there are two categories of crypto investments. You can either be a self-employed trader, which requires you to pay business taxes, or a private investor who only trades crypto part-time. In most cases, you will be classified as a private investor if you don’t plan to pursue this type of trading full-time. For tax purposes, you should also note that regulated futures are taxable as long-term capital gains, while non-regulated futures do not.

Mindset

When you’re trading cryptocurrency, you need a certain mindset in order to make good trades. Trading in cryptocurrency futures involves negotiating a price at a later time with another party. That price may be days, weeks, or months in the future. This type of trading is considered “gambling” by some because the parties making the trades are basing their decisions on speculation.

To be successful at crypto futures trading, you’ll need to have a certain mindset and have a high level of risk tolerance. You’ll also need to know exactly how derivatives work and have a good trading platform to execute your plan. And don’t forget to drink lots of coffee.

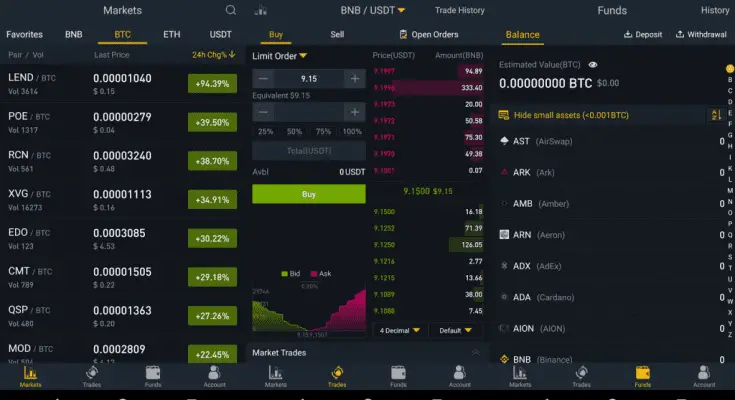

One of the best places to start learning about cryptocurrency futures is Binance Futures, an extremely liquid derivatives exchange with a massive selection of digital assets. This exchange offers traders a great opportunity to participate in the derivatives market, which witnesses trillions of dollars in volume each month.