When you get approved for a car loan or a home mortgage, where does that money come from that the bank “lends to you”? Is the bank lending you its own core capital? Whose money is being lent to you?

13 STAT 99 is the National Bank Act. This document clearly states that a bank in the United States CAN NOT lend its own capital. A bank can not lend out its own “money”, period.

The intent here is to prevent runs on banks and banks collapsing if/when loans go bad. If a bank lent out its core capital and those loans went bust, then the bank would be wiped out. Ok, so then what? What is the bank lending you when you take out a loan?

The answer is not “money” or anything that the bank owns, yet you pay back the bank principal and interest plus fees and potential penalties and destruction of your life if you fail to comply. When the bank lends you “money”, what is really happening is that the bank is creating new money with an accounting entry. The bank credits your account with a new balance equivalent to the loan. You now pay that back plus interest and fees. The bank created this money literally from nothing.

Think about this. If you loaned someone $100 at 6% per year, then you would expect to be paid back $106 by the end of that ensuing year. If there were only $100 total in the entire economy, then how would that person come up with $106 to pay you back? The current system MUST “create new money” in order to continue and survive.

It is a never ending spiral of banks “creating new money” via loans so that enough new money is created to mathematically be able to pay back all of the existing money/debt plus interest. When money is intentionally held back, then defaults soar and the system contracts sharply. New money MUST be created to keep the game going. Every time you swipe a credit card you are authorizing the Trustee (bank) to create new money. Ever wonder why credit cards are pushed so hard?

You are borrowing YOUR OWN “money” yet paying it back to the middleman (bank) plus interest and fees and penalties potentially. The bank did NOT lend you its own money. Aside from this scam the obvious implications are and have been inflation and loss of purchasing power. It’s no wonder people are flocking to Bitcoin and other services like Lolli. Even social media companies are trying to create new monetary systems.

The following is from Section 16, Paragraph 2 of the Federal Reserve Act:

2. Application for notes by Federal Reserve banks

Any Federal Reserve bank may make application to the local Federal Reserve agent for such amount of the Federal Reserve notes hereinbefore provided for as it may require. Such application shall be accompanied with a tender to the local Federal Reserve agent of collateral in amount equal to the sum of the Federal Reserve notes thus applied for and issued pursuant to such application. The collateral security thus offered shall be notes, drafts, bills of exchange, or acceptances acquired under section 10A, 10B, 13, or 13A of this Act, or bills of exchange endorsed by a member bank of any Federal Reserve district and purchased under the provisions of section 14 of this Act, or bankers’ acceptances purchased under the provisions of said section 14, or gold certificates, or Special Drawing Right certificates, or any obligations which are direct obligations of, or are fully guaranteed as to principal and interest by, the United States or any agency thereof, or assets that Federal Reserve banks may purchase or hold under section 14 of this Act or any other asset of a Federal reserve bank. In no event shall such collateral security be less than the amount of Federal Reserve notes applied for. The Federal Reserve agent shall each day notify the Board of Governors of the Federal Reserve System of all issues and withdrawals of Federal Reserve notes to and by the Federal Reserve bank to which he is accredited. The said Board of Governors of the Federal Reserve System may at any time call upon a Federal Reserve bank for additional security to protect the Federal Reserve notes issued to it. Collateral shall not be required for Federal Reserve notes which are held in the vaults of, or are otherwise held by or on behalf of, Federal Reserve banks.

Note the section highlighted in bold. It specifically says that ANY Federal Reserve Bank can apply for and receive Federal Reserve Notes from the Federal Reserve provided that the collateral posted is equal to the amount of notes applied for and distributed. Within the description of what can be used as collateral is the term “notes” along with “drafts” and “bills of exchange”. A Draft is a Bill of Exchange. A note includes the same promissory note one signs when they receive a loan for a car or a mortgage. Banks in the Federal Reserve System (yes, your bank that you use) can receive Federal Reserve Notes (i.e. “money”) by pledging your promissory note as collateral. Your signature on the note thus “creates new money”.

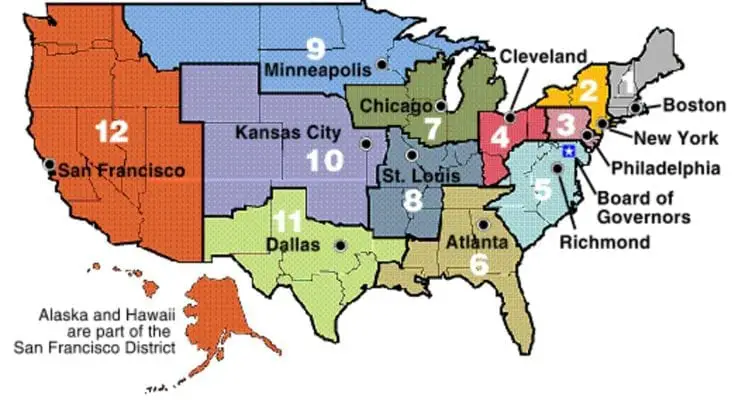

One of the other functions of the Federal Reserve is “Open Market Operations”. In fact, the Fed has an entire section devoted to it in the Federal Reserve Act. Section 14 outlines how the Federal Reserve has the authority to purchase United States obligations (or those of a state or county) NOT ONLY from domestic banks and corporations but from foreign corporations and banks as well. The Fed can intervene in the markets and bail out foreign banks and corporations (governments are corporations). This is in addition to of course doing the same domestically.

Recently on July 31, 2019, the Federal Reserve announced a change in its discount rate and reduced interest rates for the first time in many years. This could potentially lead to more “Open Market Operations” and purchasing of securities, even though the Fed continues to claim it will reduce the size of its balance sheet. Remember, the system MUST “create new money” to mathematically be able to pay the existing principal and interest on money already outstanding.

Conversation Starters: https://www.interestingfacts.org/category/conversation-starters

General Knowledge: https://www.interestingfacts.org/category/general-knowledge

Nature Facts: https://www.interestingfacts.org/category/nature-facts

World Facts: https://www.interestingfacts.org/category/world-facts

Science Facts: https://www.interestingfacts.org/category/science-facts

Definitions: https://www.interestingfacts.org/category/definition

Planets: https://www.interestingfacts.org/category/facts-about-planets

Nutrition Facts: https://www.interestingfacts.org/category/nutrition-facts

Things To Do: https://www.seatsforeveryone.com/blog

Sitemap: https://www.interestingfacts.org/sitemap.xml