What Is The Yield Curve?

As the summer of 2019 wore on, the financial media started talking and writing more and more about the “yield curve” and it going inverted. So, what the heck is a yield curve anyways and what does it mean to go inverted?

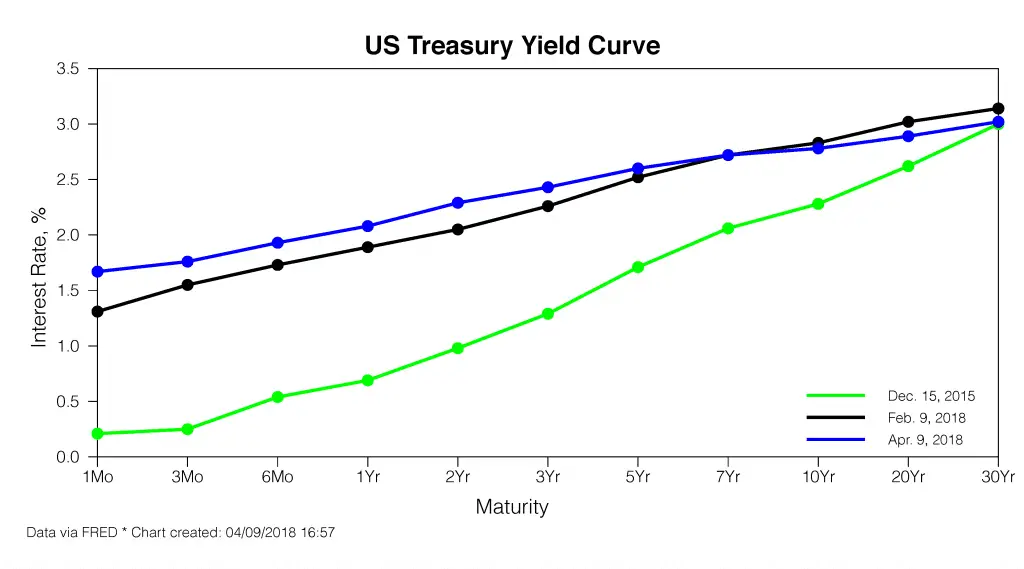

Seekingalpha.com below has an interesting piece on how we may have gotten where we are, and there are facts and editorial comments included. The yield curve is a depiction of rates on government bonds spread out over term length or maturities. Here is an image below courtesy of FRED data:

As seen above the yield (interest rates) are “generally speaking” higher as the maturity dates extend out. In a “normal economy” that is functioning “as usual” this tends to be the case. The risk of holding government paper longer is higher because the investor must account for all the possible negative outcomes that could occur over extended periods of time. Higher risk demands higher returns.

Yield Curve Inversion

Yield curve inversion occurs when short term rates are LOWER than long term rates on the curve. Hence, the curve is “inverted”. Investors claim that there is a very strong correlation between an inverted yield curve and an incoming drop in GDP and recession. This may or may not be the case.

The bigger factor now is the global move to negative interest rates. If one looks at how banks create money, they can determine on their own that money is debt! The system may in fact be heading towards an inversion of itself. The emergence of Bitcoin speaks to this and the fact we see major corporations like Facebook trying to create their own monetary system.

In a future with robots running retail, mining for Bitcoin, and getting minerals from asteroids, honestly who can say with certainty how the financial system will look. Don’t forget the calls for Universal Basic Income.

Summary If the recent yield curve panic proves anything, it proves that, in financial markets, what may start out as a mere statistical correlation, and possibly a spurious one, can become a genuine causal relationship. It was, therefore, just a matter of time before the discovery that inverted yield […]